What Drives Stock Market Returns?

One of my favorite investing books is "The Little Book of Common Sense Investing" by John Bogle. I love how Bogle breaks down investing with simplicity and offers a straightforward, no-nonsense view on finance. Best known for founding The Vanguard Group and advocating relentlessly for the individual investor, Bogle and his writings are a major influence on how we think and do business at Incline Financial Planning. In this post, I want to highlight his perspective on what drives stock returns and how he separates those returns into "investment returns" and "speculative returns."

What are investment returns?

Investment returns refer to the gains or losses made from an investment over a period. John Bogle describes these returns as comprising the dividend paid by a company plus its annual earnings growth. For example, if company XYZ pays a 4% dividend and its earnings grow by 6% annually, an investor can expect a 10% investment return.

Warren Buffett echoes this view, emphasizing that the total returns for shareholders will ultimately reflect the actual business earnings. He notes that while stock prices may temporarily diverge from business performance, over the long term, shareholders’ aggregate gains must align with the business’s earnings. In other words, the long-term returns for investors are inherently tied to the company’s fundamental performance.

What are speculative returns?

Speculative returns can either enhance or detract from investment returns. As Bogle explains, this variation hinges on investors' willingness to pay higher or lower prices for each dollar of earnings at the end of a given period compared to the beginning. This willingness is quantified by the Price to Earnings (P/E) ratio, which fluctuates based on investor sentiment—ranging from fear and concern to greed and hope.

These emotions can temporarily disrupt the steady, long-term upward trend in the economics of investing. Investment returns—comprising dividend yield and earnings growth—closely track the total market return, which includes the impact of speculative returns, over the long term. Any significant deviations between investment returns and market returns are typically short-lived.

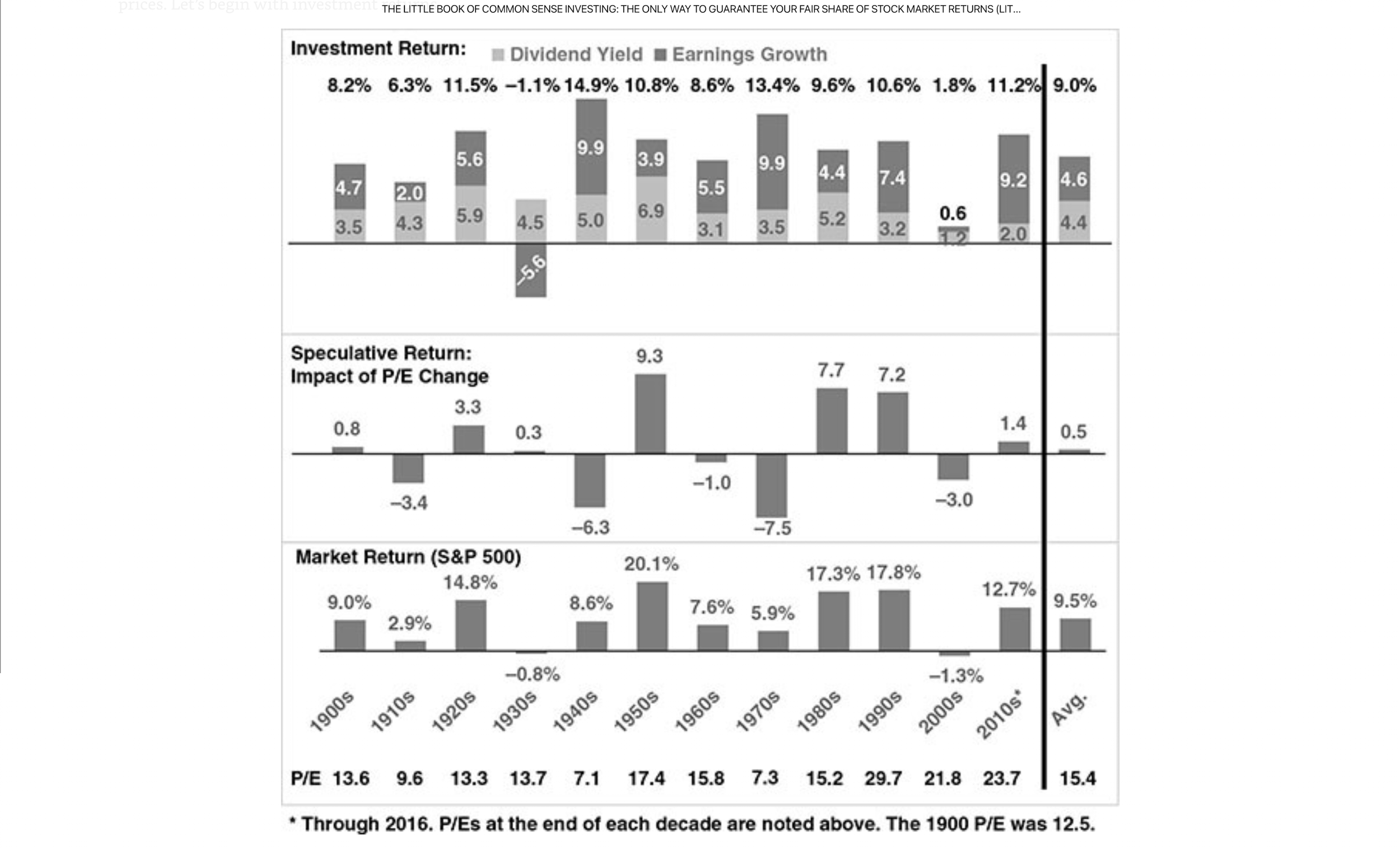

Bogle illustrates this concept using historical data that compares investment returns to market returns, highlighting the influence of the speculative return component.

*Investment Return versus Market Return. Growth of $1, 1900-2016.

The following figure illustrates how consistent investment returns are compared to the wild gyrations of human emotion that drive speculative returns. As investors' emotions flip back and forth from greed to fear, it causes variations in the multiples paid for stock, resulting in the volatility and inconsistent short-term market returns that we have come to expect.

*Total Stock Returns by the Decade, 1900-2016 (Percent Annually).

Reversion to the Mean

However, as history has shown, stock market returns tend to revert to the mean. Historically, the stock market has traded at an average of 15 times earnings. During periods dominated by greed, the market trades at higher multiples, and during periods dominated by fear, it trades at lower multiples. Bogle provides a 116-year overview in his book, from 1900 to 2016, demonstrating that over time, stocks consistently revert to this average multiple of 15 times earnings.

Conclusion

The total stock market returns are a combination of investment returns and speculative returns. As Bogle mentions, “Despite the huge impact of speculative return—up and down—during most of the individual decades, there is virtually no impact over the long term. The average annual total return on stocks of 9.5 percent, then, has been created almost entirely by enterprise, with only 0.5 percentage point created by speculation.” He goes on to say, “The message is clear: In the long run, stock returns depend almost entirely on the reality of the investment returns earned by our corporations. The perception of investors, reflected by the speculative returns, counts for little. It is economics that controls long-term equity returns; the impact of emotions, so dominant in the short term, dissolves.”

As investors, we must heed Bogle’s comments that “Accurately forecasting short-term swings in investor emotions is not possible. But forecasting the long-term economics of investing has carried remarkably high odds of success.”

The stock market, therefore, is a giant distraction from the business of investing. Focus on the long term and not the day-to-day fluctuations. In the long term, the most you can expect from your investments is the dividend yield plus the annual earnings growth that corporations produce.