Will the Presidential Election Affect the Stock Market?

Invesco recently published an article that caught my attention, especially given the heightened anxiety surrounding elections. You can read the full article [here], but we'll highlight a few key points and share our perspective.

Beware of the Fear-mongers!

No matter where you turn, you can’t escape the flood of news, social media posts, ads, and mailers all predicting disaster depending on the outcome of the upcoming election. The narrative goes: if Kamala Harris wins, we’re headed for communism, and if Trump is victorious, a dictatorship looms. Both sides suggest that if their candidate doesn’t win, it will be the end of this country as we know it.

But this is nothing new. If you've been through a few election cycles, you’re familiar with the rhetoric, the heightened fear of change, and the consistent message that this election will determine whether you'll prosper or fail. While these talking points are familiar, the current election to most, seems to carry an even greater sense of urgency.

Given that previous generations likely felt the same “doomsday” fears, it’s worth asking then when it comes to investment returns and therefore your prosperity: which party has historically led to the best investment outcomes?

Who Wins the Investment Returns Battle?

If I asked you which political party has produced better stock market returns when in power, who would you guess is the winner?

Well, you might be surprised: Neither party holds a definitive claim.

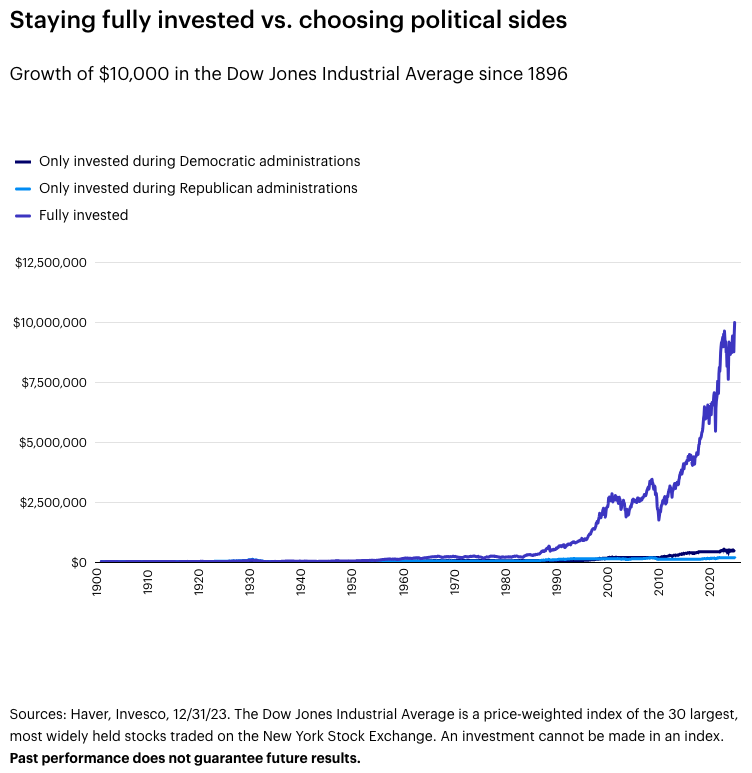

If you had invested $10,000 in the Dow Jones Industrial Average (DJIA) only when Republican presidents were in office since 1900, that investment would now be worth $181,000. However, if you had invested only during Democratic presidencies, your $10,000 would now be worth $528,000. Yet, if you stayed invested regardless of which party controlled the White House, your $10,000 would have grown to a staggering $9.9 million.

The Real Lesson: Stay Invested

At Incline Financial Planning LLC, we emphasize a core principle: just keep investing. Most of us have investment horizons of 50 years or more. During that time, we’ll experience more than 10 presidential elections, 10 midterm elections, countless wars, crises, and reasons to feel fear and uncertainty.

But as investors, the one thing we cannot afford to do is panic. The key is to stay the course. History shows that despite all the ups and downs, markets tend to rise over the long term. Elections come and go, and crises happen, but the human spirit to innovate and improve drives progress—and in turn drives the markets higher.

So, no matter what happens this election, remember that it’s not politics that will determine your financial future. It’s your discipline, your commitment to staying invested, and your belief that people—regardless of political identity—innately strive to make tomorrow better. That collective drive for progress is what ultimately makes both markets and life better over time.